Description: Tradably is a social trading platform that allows traders to share trade ideas, connect with other traders, copy trades from top performers automatically, and more. It aims to make trading more social, collaborative, and educational for retail traders.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

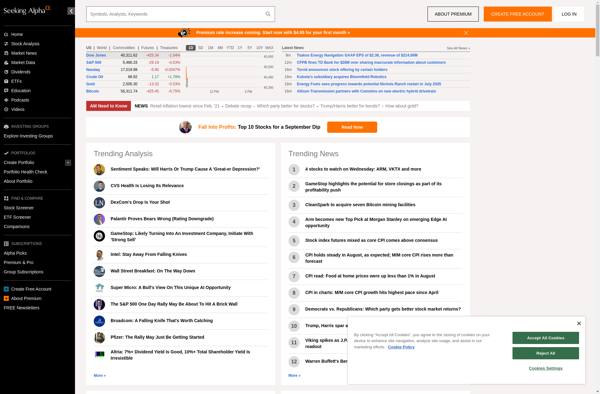

Description: Seeking Alpha is an online crowd-sourced content service for financial markets. It provides news, opinion and analysis for stocks, ETFs and mutual funds from contributors and covers earnings, dividends, and macroeconomic events.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API