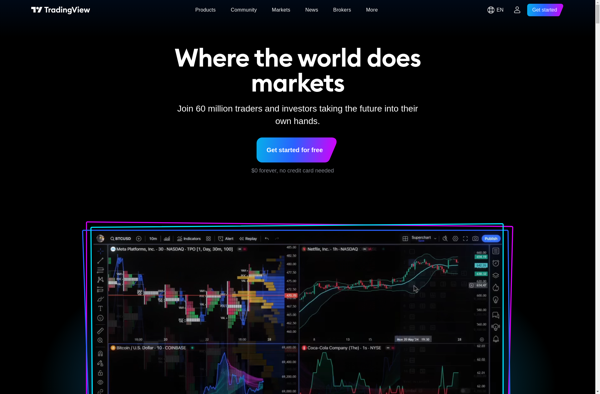

Description: TradingView is a financial platform that provides real-time information and analysis for the stock market, cryptocurrencies, commodities and more. It offers advanced features like interactive charts, technical analysis tools, news feeds, and the ability to connect with a community of traders.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Quadency is a cryptocurrency trading platform and portfolio management tool for automated trading across exchanges like Coinbase Pro, Binance, and more. It allows traders to backtest strategies and automate trades based on technical indicators.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API