Description: TravelBank is a financial wellness platform that helps companies provide tax-free commuter benefits to employees. Employees can use pre-tax dollars to pay for transit and parking costs. TravelBank aims to reduce commute-related stress and environmental impact.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

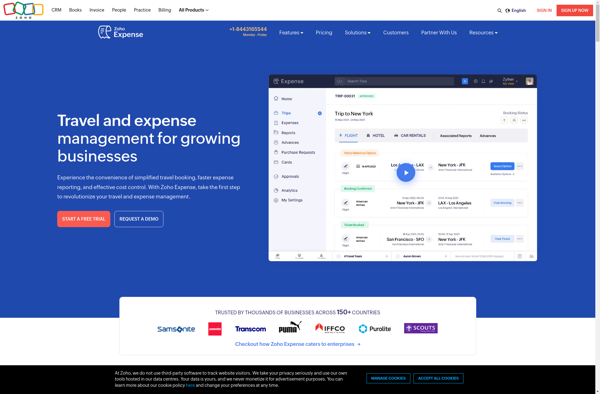

Description: Zoho Expense is a cloud-based expense reporting and reimbursement software. It allows employees to easily capture receipts, track business expenses, create expense reports, get approvals, and receive reimbursements quickly.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API