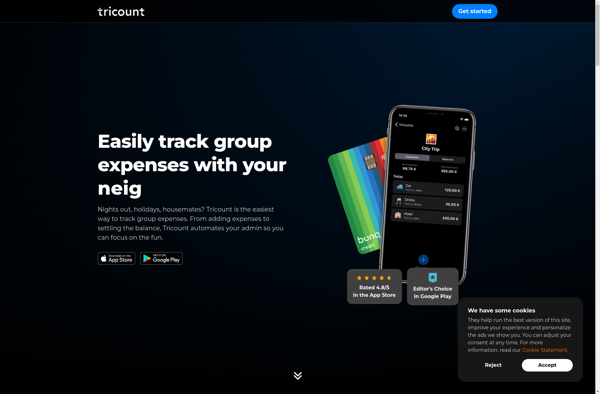

Description: Tricount is a free web and mobile app to track shared expenses and balances within groups. It allows users to easily add expenses, view group balances, and settle up. Tricount simplifies the awkwardness around money with friends.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

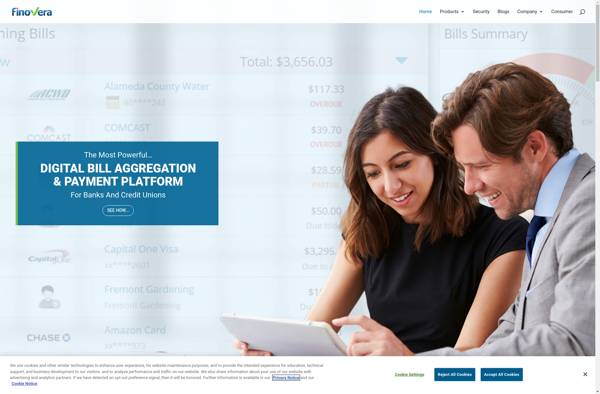

Description: Finovera is an AI-powered financial analytics platform that helps businesses make better financial decisions. It provides real-time insights into cash flow, budgets, forecasts, and more through easy-to-use dashboards and reports.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API