Description: Trill is an open-source link-in-bio platform that allows creators to have a centralized online presence with profile, portfolio, newsletter signups, donation links, etc in one place.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

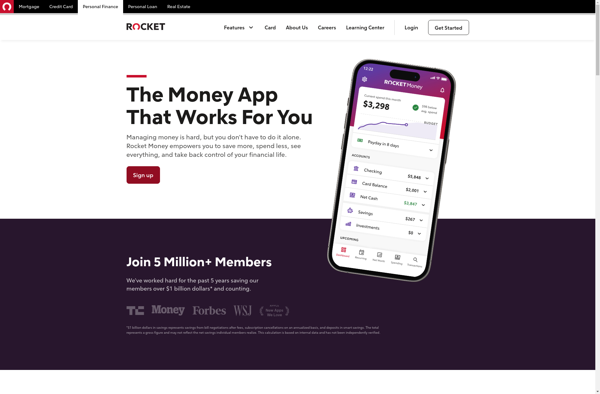

Description: Truebill is a personal finance app that helps users track subscriptions, lower bills, and manage finances. It analyzes spending, identifies wasteful subscriptions, negotiates bills, and sets budgeting goals.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API