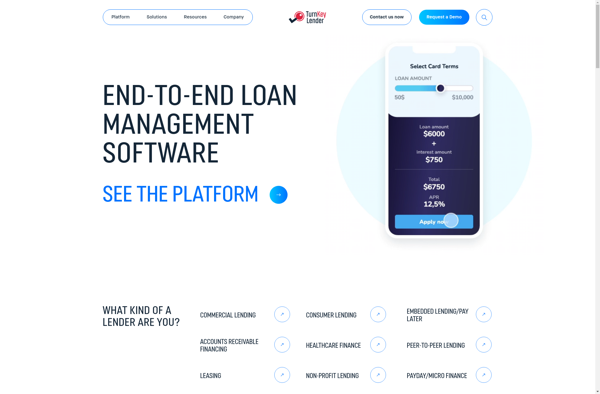

Description: TurnKey Lender is a cloud-based loan origination and management software designed for lenders of all types and sizes. It automates the entire lending process from application to funding.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: LoanBook is an open-source loan management software designed to help individuals and small organizations track loans. It allows users to record borrower details, loan amounts, interest rates, payment schedules, and more. The software provides reporting tools to monitor portfolio health.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API