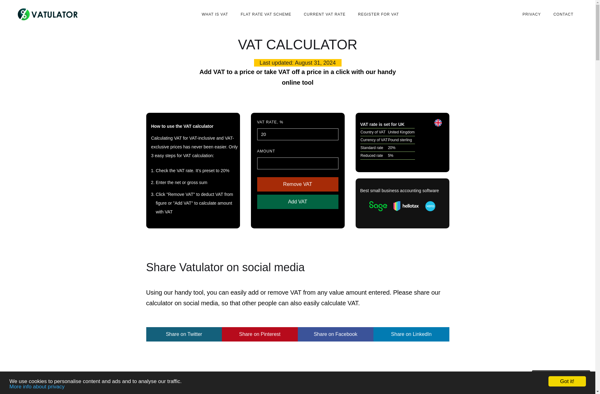

Description: Vatulator is an online VAT calculator and invoicing software designed for small businesses. It allows users to easily calculate VAT rates, generate professional VAT invoices, and manage invoices and expenses.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: VAT Calculators are software tools that help businesses calculate value-added tax (VAT) on sales and purchases. They automate VAT calculations, ensure accuracy, and save time spent on manual calculations.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API