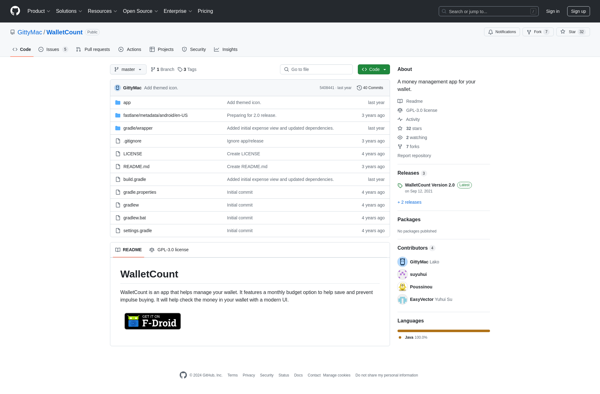

Description: WalletCount is a personal finance and budgeting app for tracking expenses. It allows users to connect bank accounts, set budgets, categorize transactions, and generate reports to visualize spending.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Budget Calendar is a personal finance app that helps users track expenses, create budgets, and manage money. It offers features like customizable categories and budgets, income/expense tracking, graphs and reports, budget alerts, cloud syncing across devices, bill reminders, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API