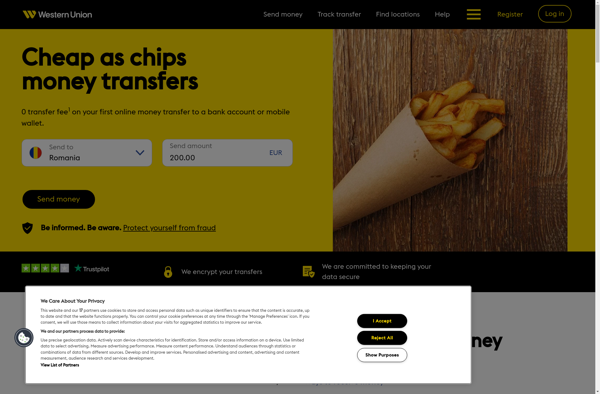

Description: Western Union is a financial services company that specializes in money transfers and payments. It offers services for sending money domestically and internationally through its global network of agent locations and online money transfer service.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

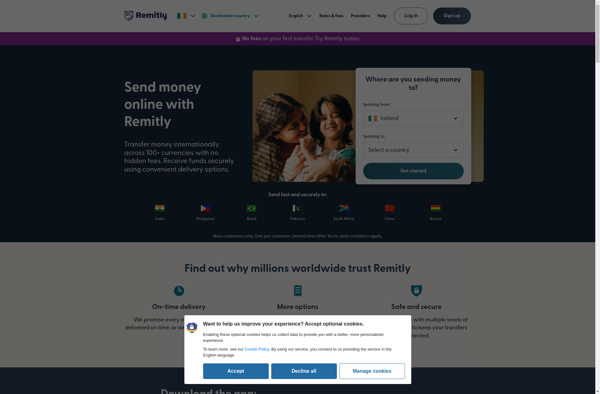

Description: Remitly is a financial services company that focuses on providing international money transfer services. Its online platform and mobile apps allow users to safely and easily send money abroad with transparent fees and exchange rates.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API