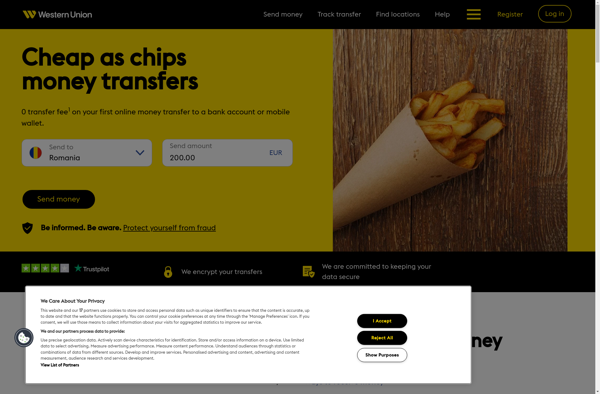

Description: Western Union is a financial services company that specializes in money transfers and payments. It offers services for sending money domestically and internationally through its global network of agent locations and online money transfer service.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Xoom is a money transfer service owned by PayPal that allows users to securely and quickly send money abroad to recipients in over 130 countries. Xoom facilitates international money transfers through cash pickups, bank deposits, and home delivery.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API