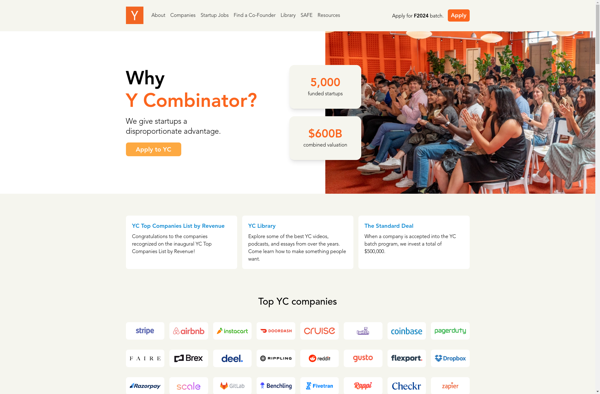

Description: Y Combinator is an American seed accelerator that provides funding, mentoring, and connections for early-stage startups. Founded in 2005, it has been instrumental in launching companies like Airbnb, Dropbox, Stripe, and Reddit.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Onevest is an alternative investment platform that allows people to invest in high-value assets like real estate, private equity, venture capital, and more. It opens up opportunities traditionally only available to institutions and accredited investors.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API