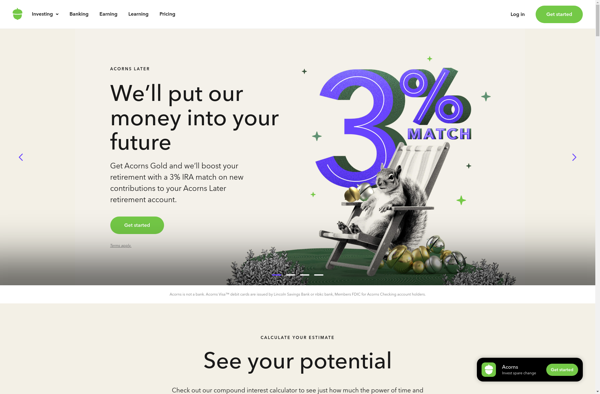

Description: Acorns is a micro-investing app that allows users to invest their spare change from everyday purchases. It automatically invests small amounts into a diversified portfolio of index funds to grow users' money over time.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Tip Yourself is a browser extension that allows users to set aside a small percentage of online purchases to send to themselves as a 'tip' or act of self-care. It rounds up purchase amounts and puts the difference into the user's Tip Yourself account.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API