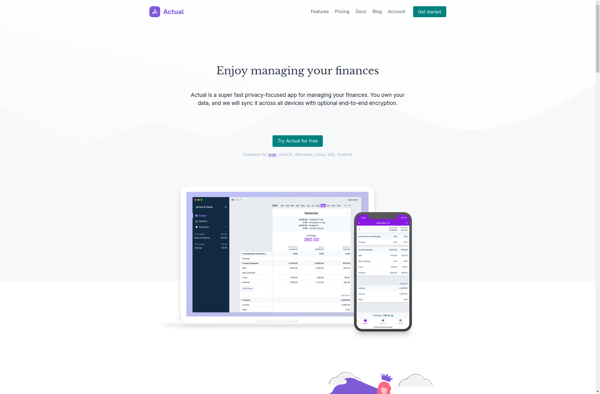

Description: Actual Budget is a personal finance software that helps users track expenses, create budgets, analyze spending habits, and manage money overall. It has features for envelope budgeting, expense tracking, reporting, forecasting, and more.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

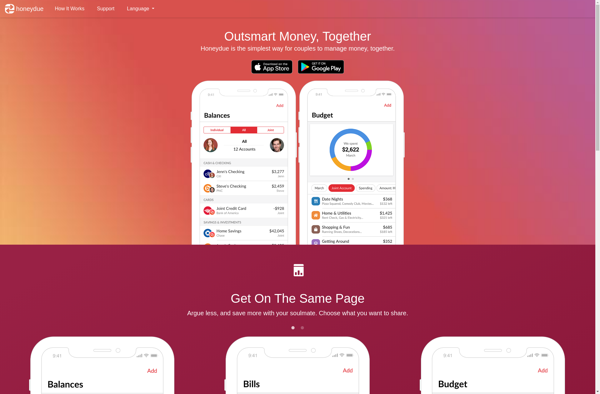

Description: Honeydue is a personal finance app designed specifically for couples to manage shared expenses, set budgets, save towards common goals, and track spending habits together. It helps couples communicate about money in a collaborative way.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API