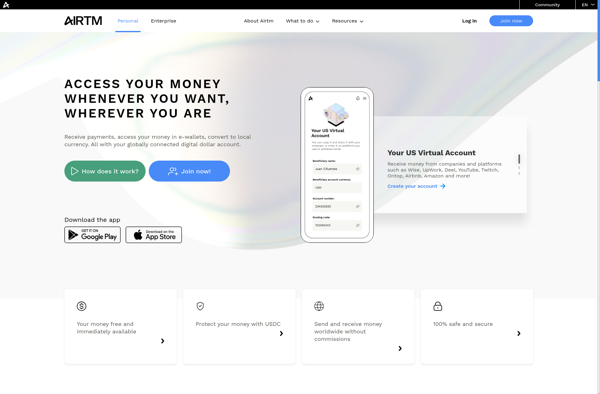

Description: AirTM is a peer-to-peer payment platform that allows people to send money internationally. It aims to provide accessible financial services to underbanked populations.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

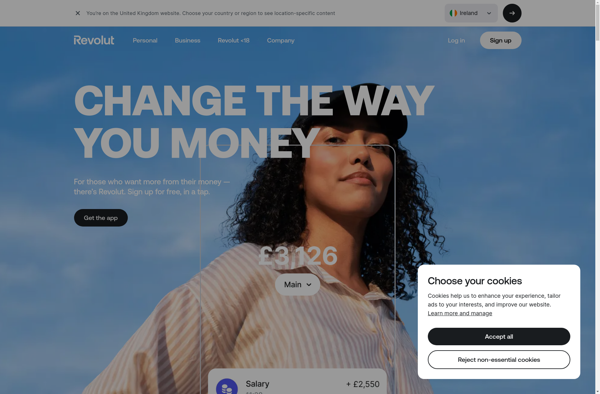

Description: Revolut is a financial services company that offers banking, currency exchange, cryptocurrency exchange, peer-to-peer payments, and other financial services through a mobile app. It aims to provide an alternative to traditional banks by offering free international money transfers, fee-free spending, and interbank exchange rates.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API