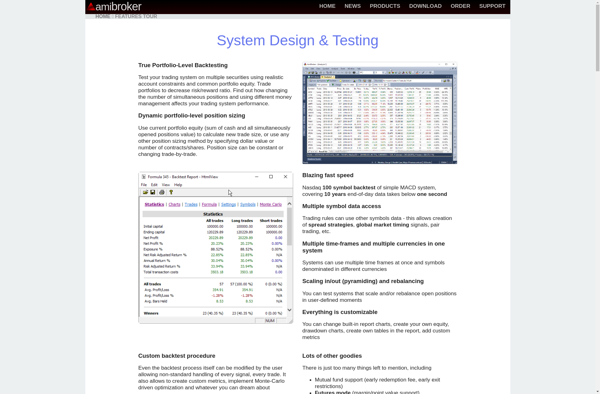

Description: AmiBroker is charting and technical analysis software for stock and financial market traders. It allows users to backtest trading strategies, optimize parameters, create custom indicators, and analyze price data.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: TD Ameritrade is an online brokerage firm that offers investing and trading services, including stocks, options, ETFs, mutual funds, futures, forex, bonds, and more. It has $1.7 trillion in client assets and offers advanced platforms, research tools, education, and 24/5 customer service.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API