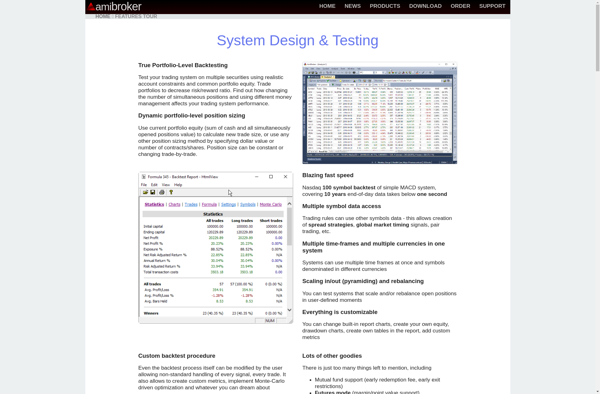

Description: AmiBroker is charting and technical analysis software for stock and financial market traders. It allows users to backtest trading strategies, optimize parameters, create custom indicators, and analyze price data.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: TickInvest is an investment suggestion website that provides stock recommendations to investors based on technical and fundamental analysis. It uses AI and machine learning to analyze market data and company financials to identify potentially profitable trades.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API