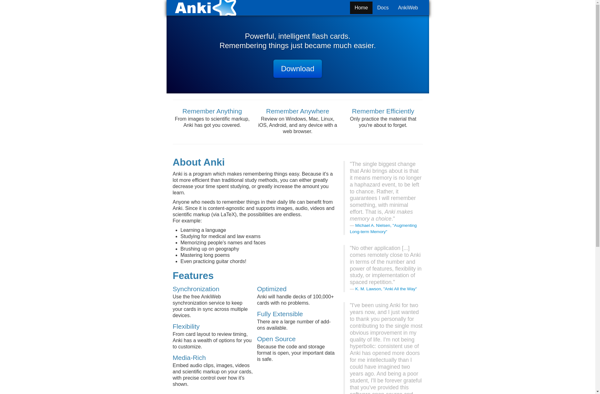

Description: Anki is a free, open-source flashcard program that uses spaced repetition to help users memorize information more efficiently. It allows users to create digital flashcards with text, images, audio, videos, and LaTeX support. Anki's algorithm schedules flashcards to show up at increasing intervals based on the user's performance to reinforce long-term memory.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: iGNUit is a free and open source personal finance manager software designed as an alternative to Quicken and Microsoft Money. It allows users to manage bank accounts, stocks, income and expenses with features like online banking downloads, reports, charts and budgeting tools.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API