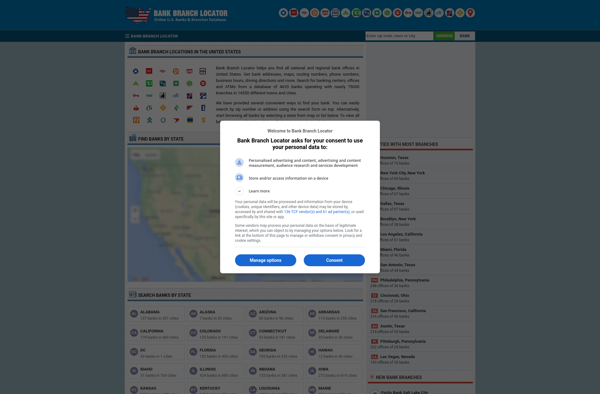

Description: Bank Branch Locator is a software that helps users find the nearest bank branch location. It typically has a search function where users enter their address or zip code, and it returns a list of the closest bank branches with key details like address, hours, phone number etc.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

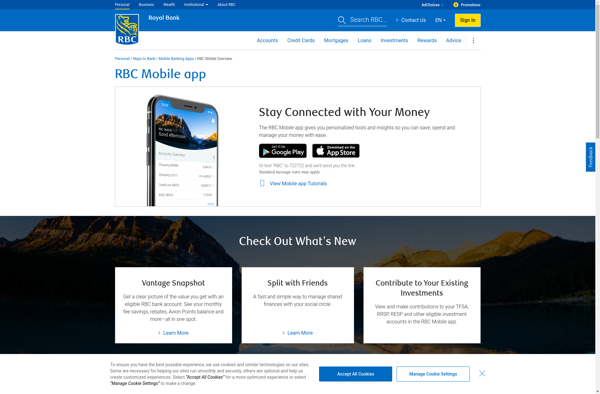

Description: RBC Mobile is a mobile banking app by Royal Bank of Canada that allows customers to check account balances, transfer money, pay bills, deposit checks, and more from their mobile device. It offers secure access, alerts, budgeting tools, and other convenient features for banking on the go.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API