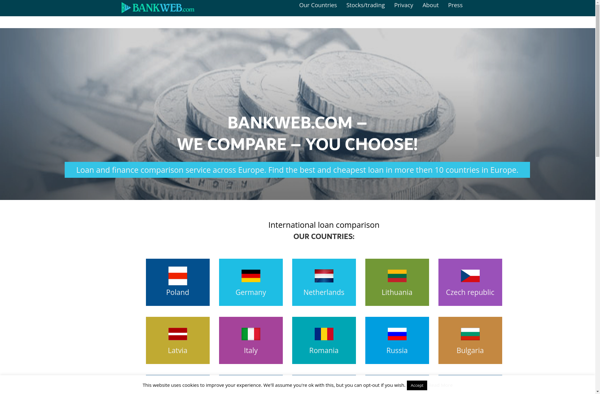

Description: Bankweb is a cloud-based core banking software designed for credit unions and community banks. It provides tools for account opening, loans, deposits, payments, compliance, analytics, and more to help financial institutions manage operations and connect with customers.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Valuta+ is a free currency converter and rates tracker app for Android. It allows you to easily convert between over 160 currencies, update exchange rates automatically, track currency changes over time, and more. The app has a simple, clean interface and is quick to use.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API