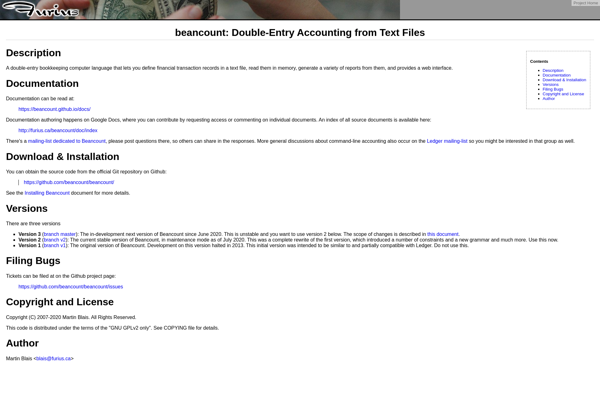

Description: Beancount is an open source command-line double-entry accounting program that lets users track bank accounts, stock portfolios, and other financial transactions. It uses a simple, text-based file format to store data and generates detailed financial reports.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: MyMoney Pro is a personal finance software that helps users manage their money, budgets, investments, and expenses. It provides an easy to use interface to track income, spending, create budgets, view reports and analyze finances.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API