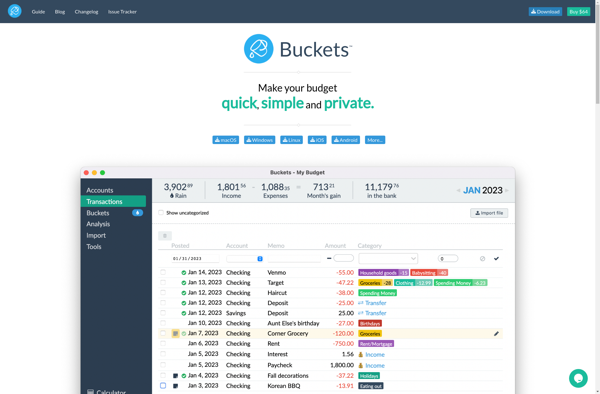

Description: Buckets Budgeting is a personal budgeting software that helps users control their finances by separating money into different categories or 'buckets'. It allows planning future expenses and savings goals.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Moneyhawk is a personal finance app that helps users track their spending, create budgets, analyze financial data, and make better money decisions. Its intuitive interface and powerful reporting make Moneyhawk a useful tool for gaining control of your finances.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API