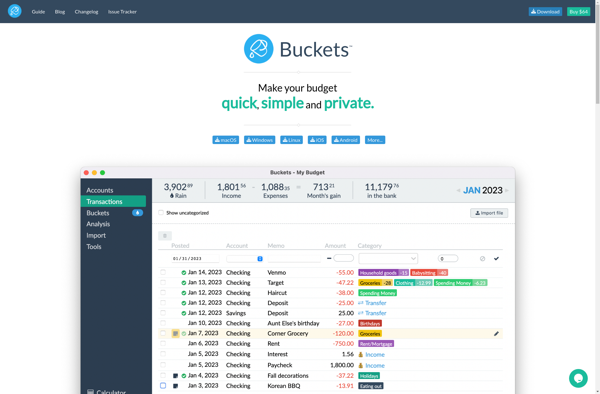

Description: Buckets Budgeting is a personal budgeting software that helps users control their finances by separating money into different categories or 'buckets'. It allows planning future expenses and savings goals.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: MoneyLine Personal Finance Software is a budgeting, expense tracking, and debt management tool designed for individuals and households. It allows users to link bank accounts, receive automated transactions, create budgets, track categories and goals, and manage bills and cash flow.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API