Description: CalendarBudget is a calendar and budget planning web application that allows users to schedule events, set budgets, and track expenses. It syncs with Google Calendar and features reporting tools to analyze spending habits over time.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

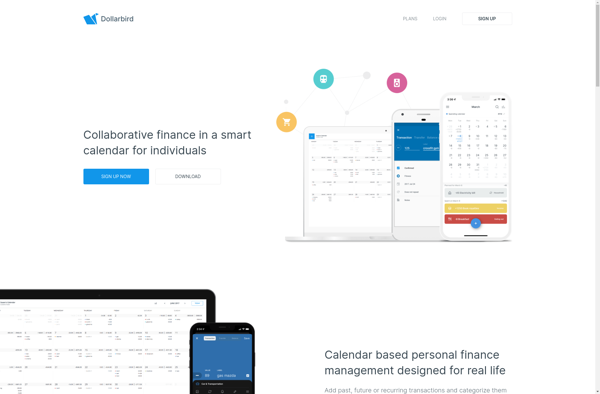

Description: DollarBird is a personal budgeting and expense tracking application. It allows users to set budgets, log expenses, track spending habits, manage bills, generate reports, and more. The app aims to provide intuitive money management across bank accounts.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API