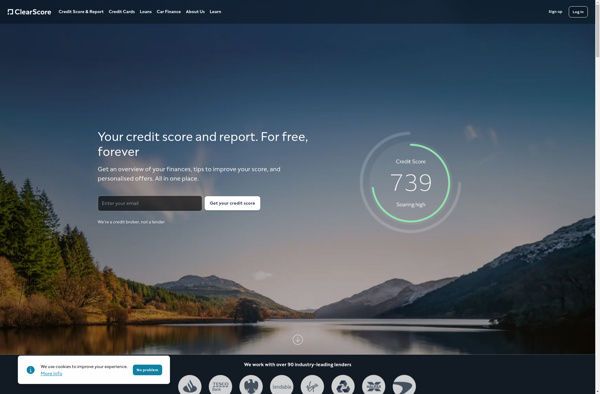

Description: ClearScore is a free credit score and report service based in the UK. It provides users with their credit score from Experian as well as a credit report, allowing them to understand their financial standing and eligibility for loans and credit cards.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

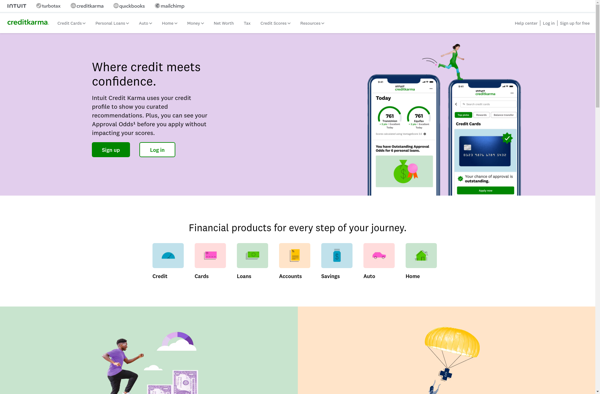

Description: Credit Karma is a free credit monitoring service that provides users access to their credit scores and reports from TransUnion and Equifax. It also provides credit card and loan recommendations based on users' credit data.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API