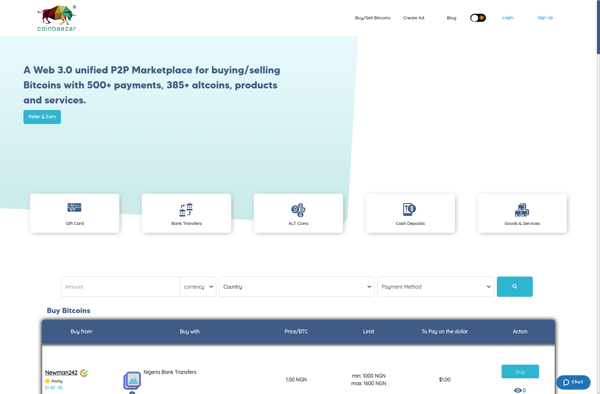

Description: Coin Baazar is a cryptocurrency exchange platform that allows users to easily buy, sell, and trade various cryptocurrencies like Bitcoin, Ethereum, and more. Its key features include a simple user interface, high liquidity, fast transaction times, multiple payment methods, and robust security.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

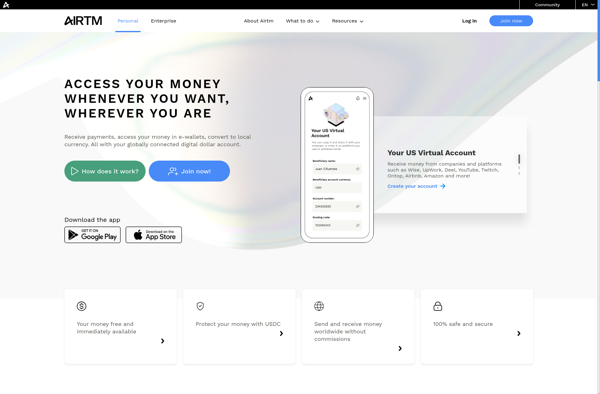

Description: AirTM is a peer-to-peer payment platform that allows people to send money internationally. It aims to provide accessible financial services to underbanked populations.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API