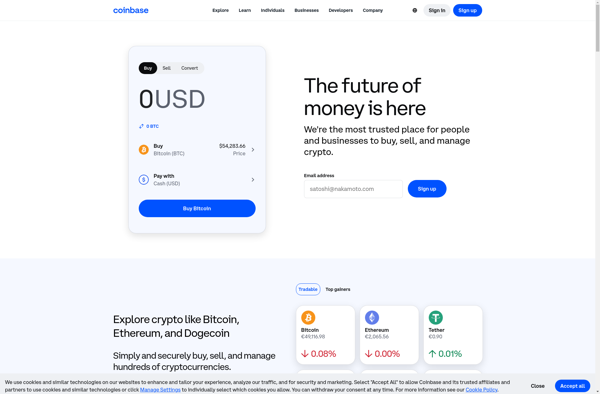

Description: Coinbase is a popular cryptocurrency exchange where users can buy, sell, and store cryptocurrencies like Bitcoin, Ethereum, and more. Its beginner-friendly interface and educational resources make crypto investing accessible.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: OTC Trade is an online platform for over-the-counter trading of financial instruments like equities, currencies, bonds, commodities, etc. It facilitates price discovery and execution of bilateral trades for non-standardized products that are not listed on exchanges.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API