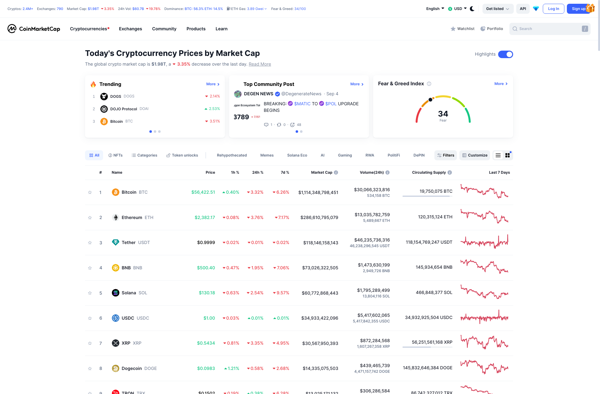

Description: CoinMarketCap is a website that tracks the price, market cap, volume and other metrics for cryptocurrencies. It offers interactive charts and tables with sortable data to analyze the crypto market.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: PumpDumpDedector is a software tool that analyzes financial message boards and social media to detect potential 'pump and dump' schemes for stocks and cryptocurrencies. It uses natural language processing and machine learning algorithms to identify posts attempting to coordinate artificial price movements.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API