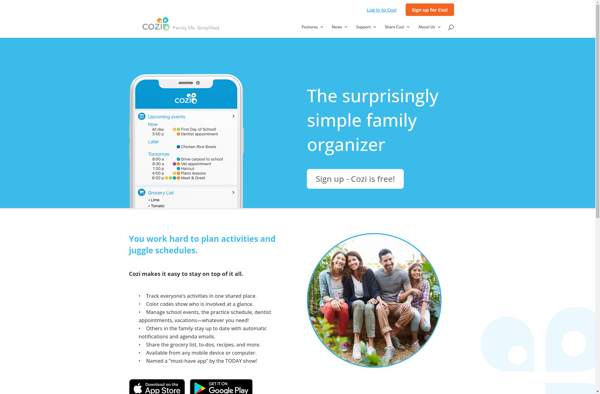

Description: Cozi is a free online calendar and organizational tool for families. It allows family members to share calendars, shopping lists, to-do lists, and other organizational features to coordinate schedules and activities.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Homechart is budgeting and financial planning software designed for home use. It helps track income, expenses, savings goals, investments, and net worth. Useful for individuals and households to manage personal finances.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API