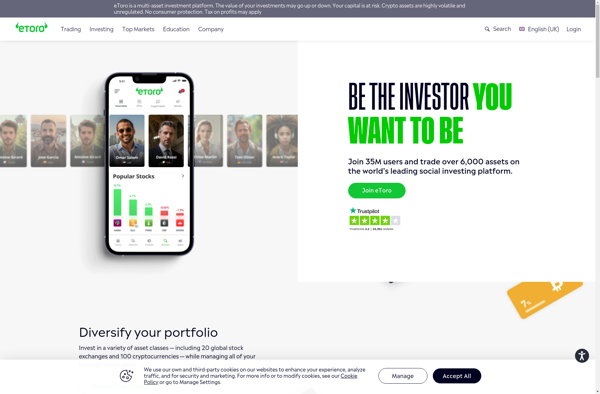

Description: eToro is a social trading platform that allows users to invest in stocks, cryptocurrencies, ETFs, and more by copying successful investors. It has a user-friendly interface and focuses on simplicity, transparency, and community.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: AvatradeACT is an automated cryptocurrency trading platform that allows users to execute trades automatically based on preset trading strategies and algorithms. It integrates with major cryptocurrency exchanges to place buy and sell orders on behalf of users.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API