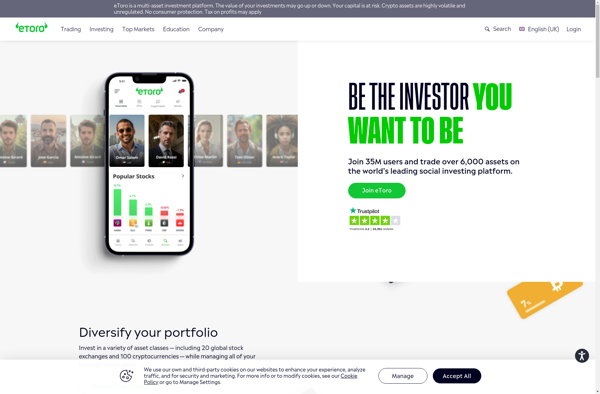

Description: eToro is a social trading platform that allows users to invest in stocks, cryptocurrencies, ETFs, and more by copying successful investors. It has a user-friendly interface and focuses on simplicity, transparency, and community.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Share Invest is an investment platform that allows users to create personalized exchange traded funds (ETFs). It uses advanced algorithms to construct a customized ETF portfolio based on the user's investment goals, risk tolerance, and values.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API