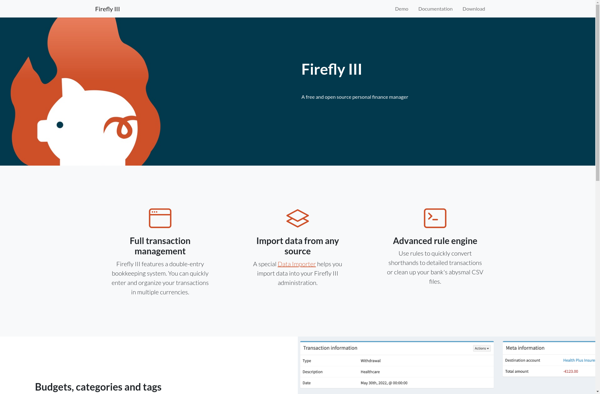

Description: Firefly III is an open-source personal finance manager that helps users track their spending and manage their finances. It offers features like budgeting, transaction reporting, and visualizing net worth over time.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: BillPin is a personal finance app that helps users track expenses, create budgets, and manage bills. It has features for tracking spending across categories, setting budget goals, scheduling bill payments, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API