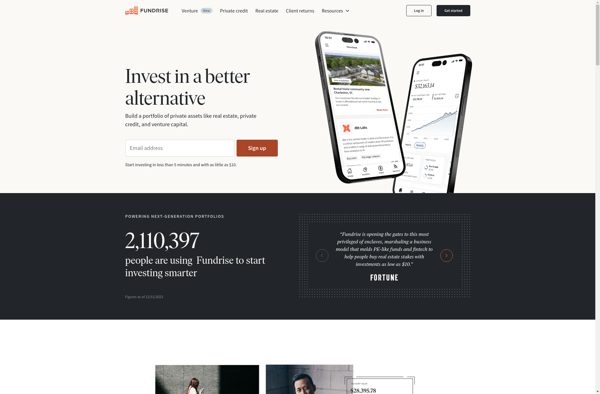

Description: Fundrise is an online investment platform focused on real estate crowdfunding. It allows users to browse and invest in residential and commercial real estate projects across the U.S., offering lower investment minimums and fees than traditional private investment funds.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

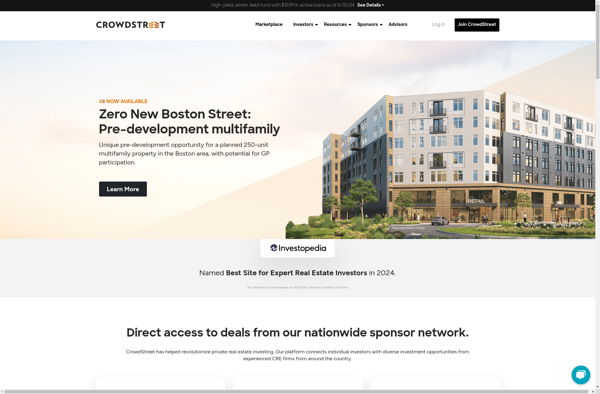

Description: CrowdStreet is an online commercial real estate investment marketplace that allows accredited investors to browse and invest in institutional-quality commercial real estate projects. Investors can diversify their portfolios by investing small amounts into individual deals.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API