Description: GoFundMe is a popular crowdfunding platform that allows people to raise money for events, causes, and personal needs. It makes it easy for individuals, groups, and organizations to create fundraising campaigns and share them across social media to collect donations.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

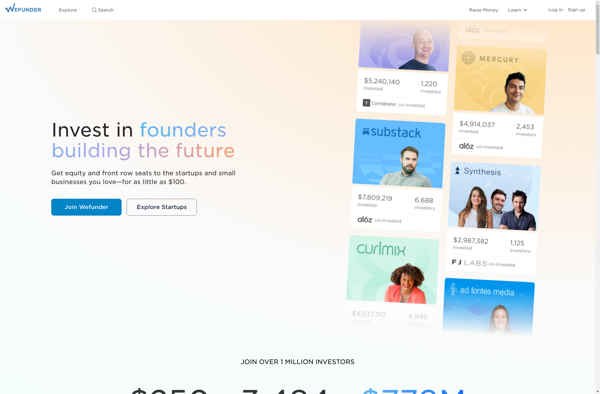

Description: Wefunder is an equity crowdfunding platform that allows startups and small businesses to raise funds from both accredited and non-accredited investors. It streamlines the process of raising capital through securities offerings.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API