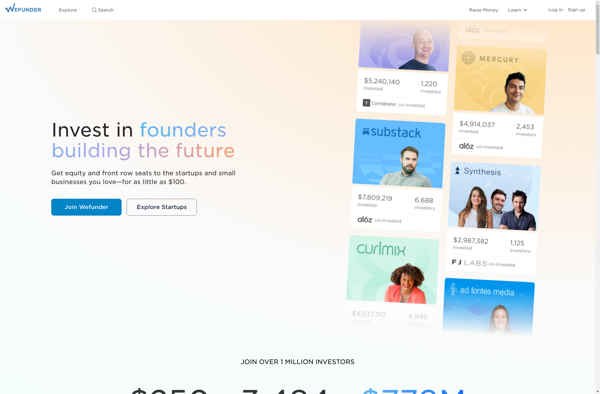

Wefunder

Wefunder: Equity Crowdfunding Platform for Startups & Small Businesses

Discover Wefunder, an innovative equity crowdfunding platform facilitating capital raises for startups and small businesses, catering to both accredited and non-accredited investors.

What is Wefunder?

Wefunder is an equity crowdfunding platform launched in 2012 that allows startups and small businesses to raise funds from both accredited and non-accredited investors. It operates under Regulation Crowdfunding rules that were introduced in 2016 under the JOBS Act, which expanded access to early-stage capital for entrepreneurs.

Wefunder streamlines the process for startups and small businesses to raise funds through securities offerings like SAFEs and convertible notes. It handles all the SEC compliance and legal paperwork involved with issuing securities and allows companies to market their fundraising campaigns. Investors can browse startup profiles and invest directly on the Wefunder website.

Key features of Wefunder include investor access for both accredited and non-accredited investors, marketing tools and advice for startups raising funds, automated SEC filings and compliance, and portfolio management tools. Wefunder charges a platform fee on funds raised but does not take any equity from issuers. Over $200 million has been raised by hundreds of companies on Wefunder.

In summary, Wefunder is a leading equity crowdfunding platform that has helped democratize access to capital for early-stage startups and small businesses. It allows a wider pool of investors to fund private companies and has robust tools and resources both for issuers raising funds and investors looking to build a portfolio.

Wefunder Features

Features

- Allows startups and small businesses to raise funds through equity crowdfunding

- Provides a platform for accredited and non-accredited investors to invest in startups

- Streamlines the process of raising capital through securities offerings

Pricing

- Subscription-Based

Pros

Cons

Official Links

Reviews & Ratings

Login to ReviewThe Best Wefunder Alternatives

Top Business & Commerce and Crowdfunding and other similar apps like Wefunder

Here are some alternatives to Wefunder:

Suggest an alternative ❐FundRazr

Goteo

GoFundMe

Kickstarter

MintMe

Kiva

Citizinvestor