Description: Google Finance is a website by Google that provides real-time market data, financial news and tools for investors to track stocks, bonds, mutual funds and more. It offers customizable quotes, interactive charts and personal finance management.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

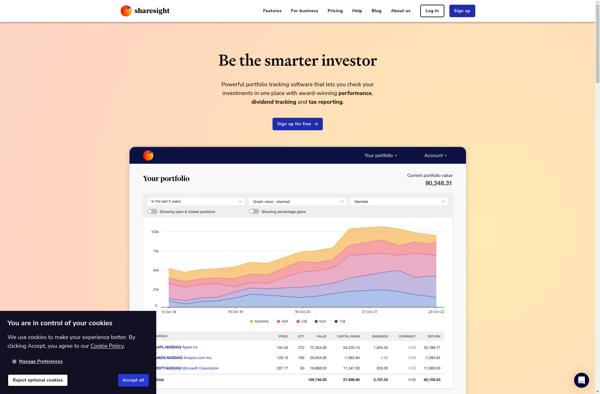

Description: Sharesight is an online portfolio tracker and performance reporting tool for investors. It allows you to consolidate all your investment holdings from various brokers, banks and platforms to track performance, tax, dividends and more in one place.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API