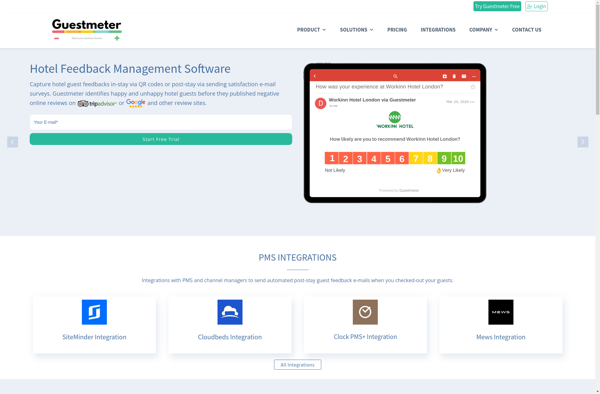

Description: Guestmeter is visitor analytics software that provides insights into website visitors. It tracks valuable visitor data like location, referral sources, bounce rates, and more to help understand audience behavior.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: EZYield Fuzionlink is a cloud-based software platform for mortgage lenders that automates many manual processes to increase efficiency and reduce costs. It integrates with LOS systems and includes product and pricing engine, underwriting and closing tools, co-issue and hedging capabilities, and robust reporting.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API