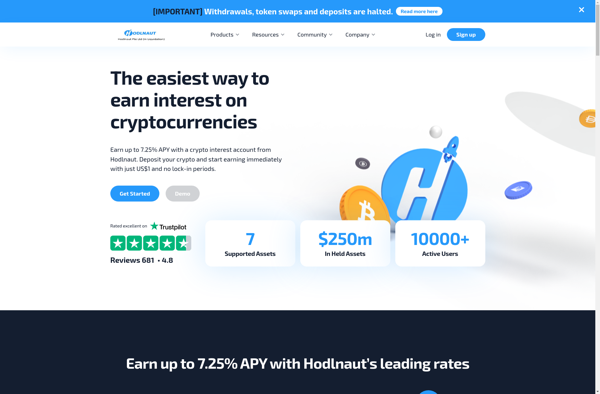

Description: Hodlnaut is a cryptocurrency lending and borrowing platform based in Singapore. It allows users to earn interest on their crypto assets by lending them out or to borrow crypto assets against collateral.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Crypto.com is a cryptocurrency platform and exchange that allows users to buy, sell, store, send, and track cryptocurrencies. It offers a mobile app, exchange, crypto debit card, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API