Description: Hundy is a lightweight and easy-to-use budgeting app designed to help users track their income and expenses. It allows users to set budgets, log transactions, and monitor spending habits over time. Key features include customizable categories and budgeting goals, graphical reports for tracking spending, and syncing across devices.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

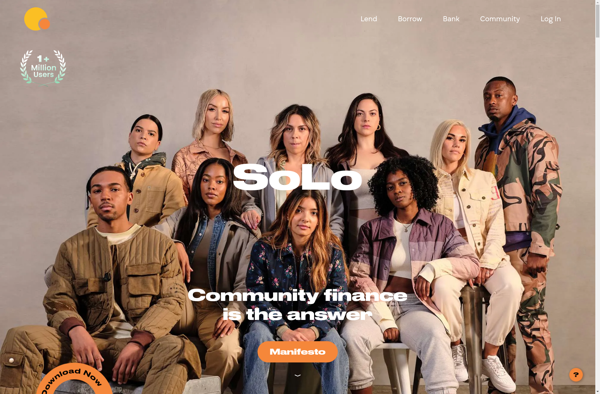

Description: SoLo Funds is a peer-to-peer lending platform that allows users to lend and borrow money from each other without the need for a middleman. It aims to provide affordable financial services by cutting out traditional financial institutions.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API