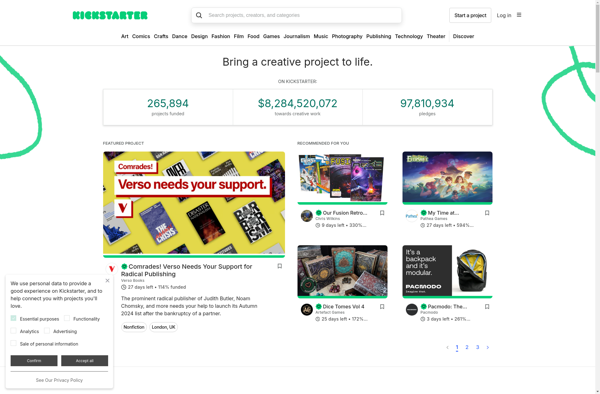

Description: Kickstarter is a global crowdfunding platform where creative projects can get funding. Project creators make a pitch to support their ideas and the community can pledge money to make them happen.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Kiva is a nonprofit organization that allows people to lend money via the Internet to low-income entrepreneurs and students in over 80 countries. Kiva's mission is to connect people through lending to alleviate poverty.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API