Description: KiwiBudget is a free, open-source personal budgeting software for Windows. It allows users to track income, expenses, savings goals, and more. Key features include reports, reminders, cloud sync, and custom categories.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

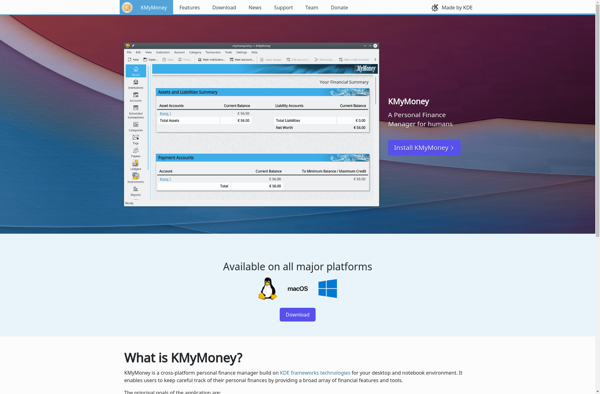

Description: KMyMoney is an open-source personal finance manager software for Linux. It allows users to track bank accounts, stocks, budgets, and other financial accounts to help manage personal finances.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API