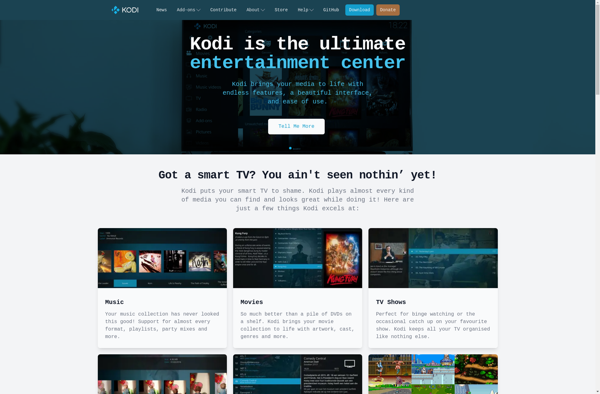

Description: Kodi is an open-source media center application that allows users to play videos, music, podcasts, and other digital media files from local storage or the internet. It provides a customizable interface and supports a wide range of formats.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

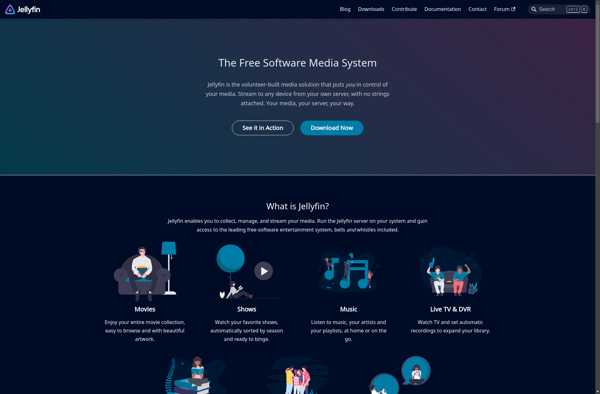

Description: Swiftfin is a personal finance management app that helps users track their spending, create budgets, monitor account balances, analyze financial trends, and optimize savings. Its intuitive interface and automation features make personal finance simple.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API