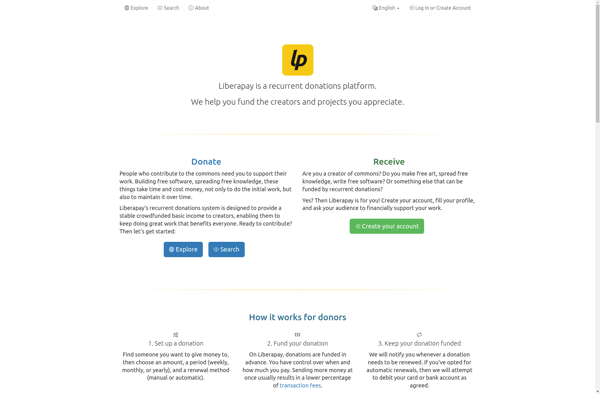

Description: Liberapay is an open source recurring donations platform. It allows creators, developers, organizations and individuals to receive regular financial support from their audience and community. Liberapay aims to provide an alternative to other donation platforms through its focus on transparency, open data, and lower fees.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: PeachPay is an easy-to-use payment processing application designed for small businesses. It allows entrepreneurs to accept credit card payments in-store, online, or on mobile devices through an intuitive interface and competitive transaction rates.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API