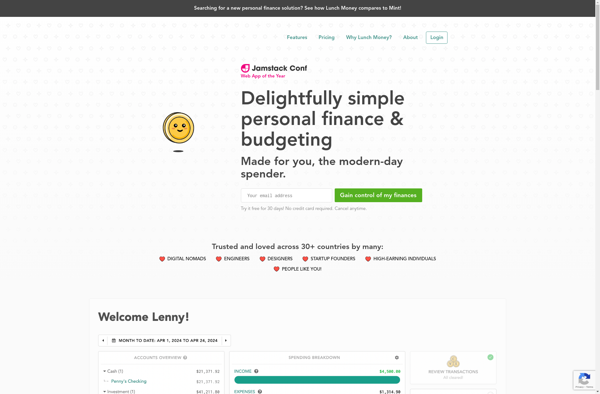

Description: Lunch Money is a personal finance and budgeting app that automatically tracks your expenses and income. It categorizes transactions, lets you set budgets for categories, and provides reporting on your spending habits over time.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Banktivity is a personal finance and budgeting software for Mac users. It allows you to track bank accounts, income, spending, investments, and net worth. Key features include online banking connectivity, customizable reports and budgets, calendar-based transaction entry, and robust security.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API