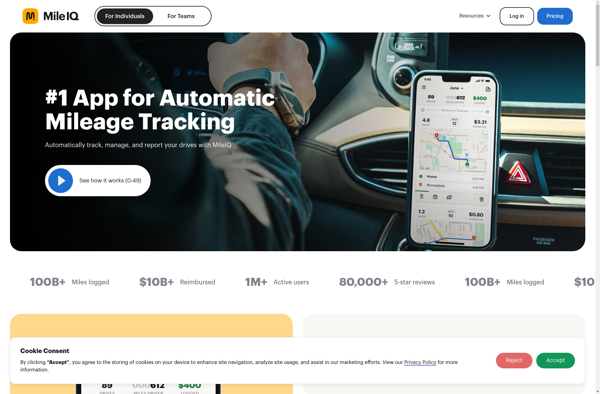

Description: MileIQ is a mileage tracking and reporting app for individuals and small businesses. It automatically logs driving trips using GPS and calculates tax-deductible business miles. Key features include automatic trip logging, mileage reports, integration with accounting software, and reminders for tax season.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Mileage is a mileage and expense tracking app for individuals and small businesses. It offers easy tools to track miles driven, vehicle expenses, trip details and tax deductions all in one place.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API