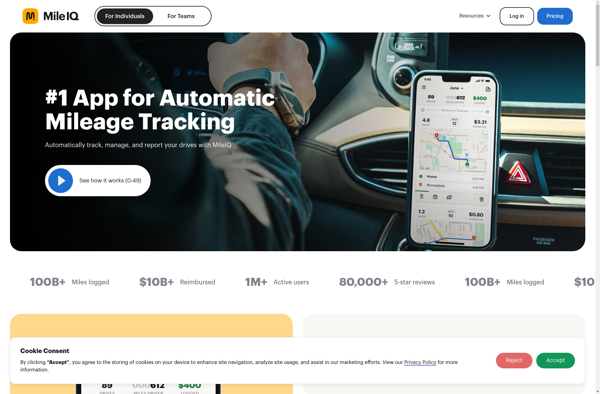

Description: MileIQ is a mileage tracking and reporting app for individuals and small businesses. It automatically logs driving trips using GPS and calculates tax-deductible business miles. Key features include automatic trip logging, mileage reports, integration with accounting software, and reminders for tax season.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Road Trip MPG is a car trip mileage and expense tracker app. It allows users to log details about road trips such as destinations, mileage, fuel efficiency, and expenses. The app calculates totals and expense statistics to help plan efficient and cost-effective trips.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API