Description: Moneyplex is a personal finance management software that helps users track expenses, create budgets, analyze spending habits, manage investments, and plan for retirement. It has an intuitive interface and powerful reporting tools.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

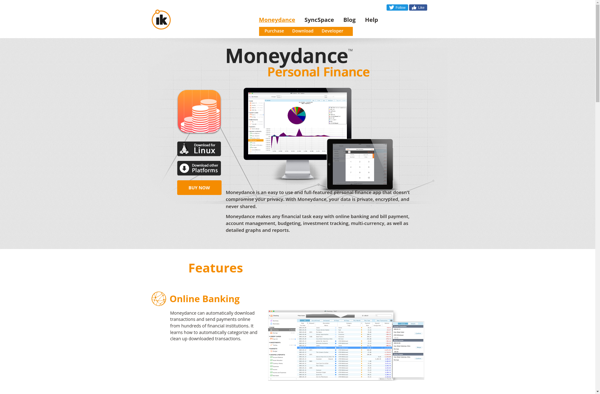

Description: Moneydance is a personal finance software used for tracking budgets, managing accounts, reconciling transactions, and generating reports. It has features for online banking, investing, debt tracking, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API