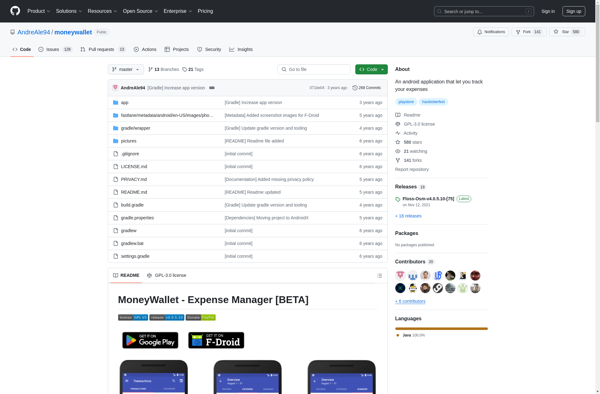

Description: MoneyWallet is a personal finance manager app that allows users to track their income, spending, budgets, goals, investments, and net worth. It has an intuitive interface, useful reports and graphs, supports multiple currencies, connects bank accounts, and is available on iOS, Android, Mac, and Windows.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Billsup is an online invoicing and billing software designed for freelancers and small businesses. It allows users to create professional invoices, track payments and expenses, manage clients and projects, and automate billing and invoicing workflows.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API