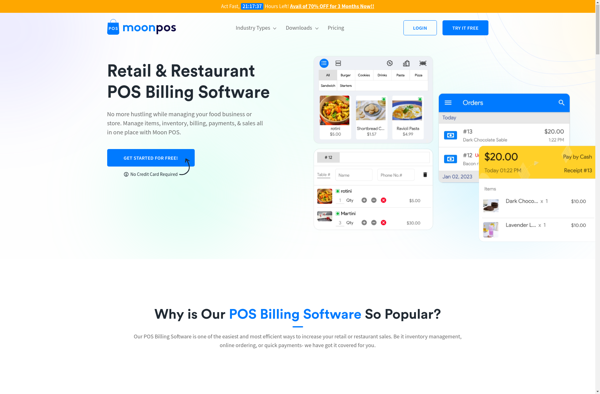

Description: Moon POS is a cloud-based point of sale system designed for bars, restaurants, and retail businesses. It offers tools to manage sales, inventory, staff, loyalty programs, and reporting.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Taxpay is a tax filing and preparation software designed to help individuals and small businesses file taxes accurately and maximize returns. It has an intuitive interface, robust reporting features, and guidance for deductions and credits.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API