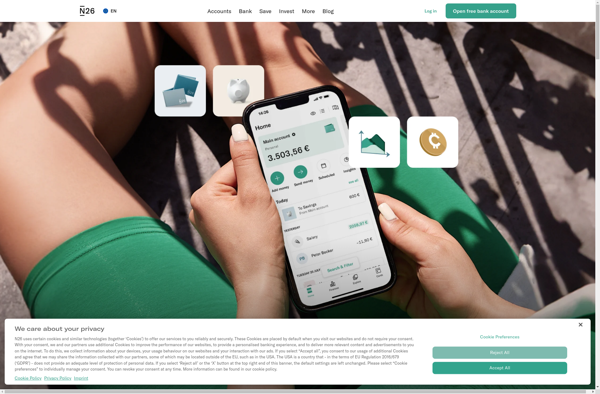

Description: N26 is a mobile bank that offers a free account with no hidden fees. It allows users to manage their finances, transfer money instantly, withdraw cash for free worldwide, and has budgeting tools and financial insights.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Monzo is an online bank based in the UK that offers current accounts, business accounts, joint accounts, and accounts for 16-17 year olds. It has a popular app with budgeting and spending insights tools.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API