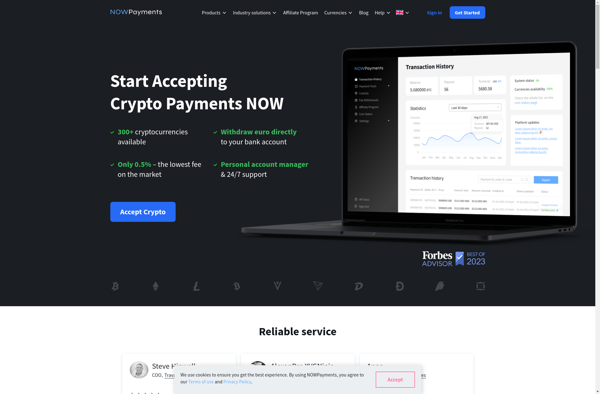

Description: NOWPayments is a cryptocurrency payment processor that allows merchants to accept payments in over 100 cryptocurrencies including Bitcoin, Ethereum, Litecoin, and more. It offers easy integration, no hidden fees, global coverage, and support for ecommerce and physical store payments.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: CoinPayments is a platform that allows merchants to accept cryptocurrency payments easily and securely. It supports a large number of popular coins and integrates into most ecommerce checkout systems.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API